Alfred Rappaport Shareholder Value Pdf Reader

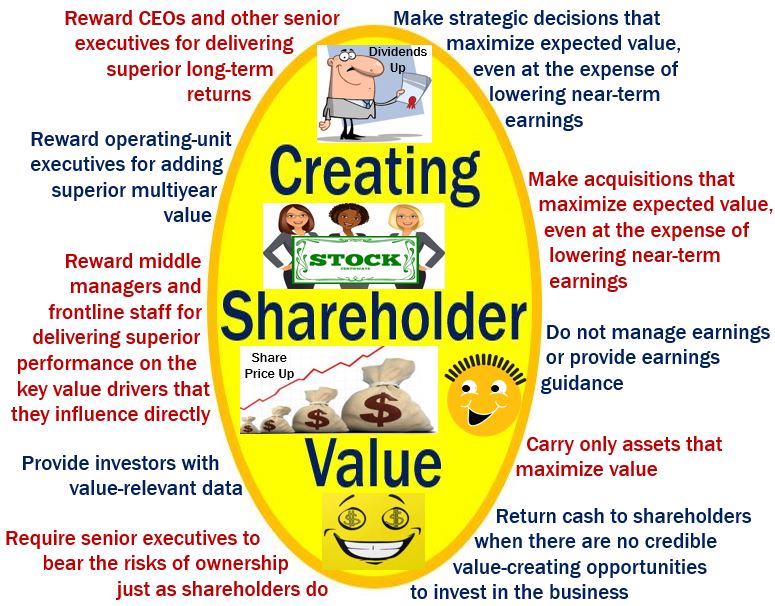

Work Is Wonderful. By Don Bauder, Sept. La Jolla’s Alfred Rappaport. Rappaport wrote a very interesting paper on ten ways to increase shareholder value,. Download creating shareholder value or read online books in PDF, EPUB, Tuebl, and Mobi Format. Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. The empirical analysis aims to provide the reader a quantification of the impact of environmental. The ultimate test of corporate strategy, the only reliable measure, is whether it creates economic value for shareholders. Now, in this substantially revised and updated edition of his 1986 business classic, Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. The ultimate test of corporate strategy, the only reliable measure, is whether it creates economic value for shareholders. Now, in this substantially revised and updated edition of his 1986 business classic, 'Creating Shareholder Value', Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. PDF off (no printing) ePub off (no printing) eb20 20% every 30 days. Creating Shareholder Value, Alfred Rappaport provides managers and investors with the practical tools needed to generate superior returns. After a decade of downsizings frequently blamed on shareholder value decision making, this book presents a new and indepth assessment. Companies profess devotion to shareholder value but rarely follow the practices that maximize it. What will it take to make your company a level 10 value creator? By Alfred Rappaport I SIMON PEMBERTON Ways to Create Shareholder Value.

- Shareholder Value Definition

- Alfred Rappaport Shareholder Value Pdf Reader Online

- Alfred Rappaport Shareholder Value Pdf Readers

- Alfred Rappaport Shareholder Value Pdf Reader Pdf

Table of Contents

TABLE OF FIGURES

LIST OF TABLES

FREQUENTLY USED SYMBOLS

1 INTRODUCTION

2 RATIONALE FOR THE SHAREHOLDER VALUE APPROACH

2.1 VALUE-BASED MANAGEMENT

2.1.1 Shareholder versus Management Interests

2.1.2 The Relation to other Stakeholders

2.2 SHORTCOMINGS OF ACCOUNTING NUMBERS

2.2.1 Unreliable Performance Measurement – Earnings

2.2.1.1 LIFO versus FIFO

2.2.1.2 The Amortization of Goodwill

2.2.1.3 Time Value of Money

2.2.2 Return on Investment (ROI) and Return on Equity (ROE)

2.2.3 Long-term View

2.2.4 Intellectual Capital

3 SHAREHOLDER VALUE ANALYSIS METHODS

3.1 RAPPAPORT’S FRAMEWORK FOR VALUE CREATION

3.1.1 The Estimation of the Cash Flow

3.1.2 Cost of Capital

3.1.2.1 Cost of Equity

3.1.2.1.1 The Risk-Free Rate

3.1.2.1.2 The Market-Risk Premium

3.1.2.1.3 Estimating the Systematic Risk

3.1.2.2 Cost of Debt

3.1.3 Residual Value

3.1.4 Rappaport’s Shareholder Value Network

3.2 COPELAND, KOLLER AND MURRIN APPROACH (MCKINSEY)

3.3 ECONOMIC VALUE ADDED (EVA®)

4 ASSESSMENT OF THE SHAREHOLDER VALUE ANALYSIS METHODS

4.1 SIMILARITIES & DISTINCTIONS

4.2 PROBLEMATIC ISSUES

4.2.1 Information Deficits

4.2.2 Hockey-Stick Effect

4.2.3 Compound Problem

4.2.4 Manipulation Problem

5 PERFORMANCE EVALUATION AND COMPENSATION SYSTEMS

5.1 AGENCY THEORY OVERVIEW

5.2 PRINCIPAL-AGENT CONFLICTS

5.2.1 Adverse Selection

5.2.2 Moral Hazard

5.2.3 The Horizon Problem

5.2.4 Risk Differential Behavior

5.3 COMPENSATION SYSTEMS

5.3.1 Recent Research

5.3.2 Performance Measurement

5.3.3 Stock Options

5.3.3.1 Rewarding Outperformance

5.3.3.2 Including Operating Units and Setting Targets

5.4 E-BUSINESS: A PARADIGM FOR INNOVATIVE PERFORMANCE DRIVEN COMPENSATION SYSTEMS

6 PROSPECT AND DEVELOPMENT

7 CONCLUSION

REFERENCES

Table of Figures

FIGURE 1: EPS GROWTH IS A POOR PREDICTOR FOR SHAREHOLDER VALUE

FIGURE 2: SECURITY MARKET LINE (SML)

FIGURE 3: THE WEIGHTED AVERAGE COST OF CAPITAL (WACC)

FIGURE 4: THE SHAREHOLDER VALUE NETWORK

FIGURE 5: COMPARISON OF TOTAL VALUE DISTRIBUTION BASED ON DIFFERENT FORECAST PERIODS

FIGURE 6: HOCKEY-STICK EFFECT

FIGURE 7: AGENCY PROBLEMS

FIGURE 8: COMPENSATION SYSTEM IN COMBINATION WITH THE SHAREHOLDER VALUE NETWORK

FIGURE 9: HOLISTIC COMPENSATION SYSTEM

List of Tables

TABLE 1: ELEMENTS OF THE SHAREHOLDER VALUE METHODS

Frequently Used Symbols

illustration not visible in this excerpt

1 Introduction

“The fundamental goal of all business is to maximize shareholder value.”1 This statement has become commonplace not only in corporate America, but it is also the imperative statement of business around the world. A failure to seek to maximize shareholder value results in pressure from the board of directors and activist shareholders. The takeover movement of the latter half of the 1980s provided another powerful incentive for managers to focus on creating value. This is grounded on the fact that the only compelling takeover defense is to deliver superior shareholder value.

Given the globalization of capital markets and their diminishing boundaries, economic systems will slowly run out of capital, if they are unable to create shareholder wealth and thereby attract investors. If economic systems are unable to provide superior or at least satisfying returns they will fall further and further behind in global competition and will lose employment opportunities. Thus, a value-based system grows in importance as capital becomes more mobile.

Although shareholder value metrics and value-based management are widely known they are far from being universally applied. Years of restructuring and employee layoffs frequently attributed to shareholder value considerations coupled with self-interested

management and shortsighted focus on current stock price has promoted frustration and uncertainty.2 Thus, it is critical to fully understand the shareholder value approach and its variants. Additionally, it is vital for the shareholder value approach that the objectives of the mangers and the company’s shareholders are aligned and focused on delivering superior shareholder value. The relationship between manager and stockholder can best be examined by the agency theory that studies the contract between agents (e.g. managers) and principals (e.g. stockholders).3 An overview of a holistic shareholder value and agency based compensation system is the topic of this paper.

Based on the above discussion this paper first introduces the shortcomings of traditional accounting numbers and reveals the need for a more reliable measure: shareholder value. The third chapter then explains the shareholder value approach and three key methods are introduced: Rappaport’s shareholder value added (SVA), Copeland, Koller and Murrin’s

total shareholder value, and Stern and Stewart’s economic value added (EVA). The following section reveals the major differences, respectively similarities of these methods in the areas of determination of the relevant cash flow and the cost of capital as well as the calculation of the residual value. Moreover, it indicates problems of which the manger should be aware of when applying shareholder value measurements. Chapter 5 introduces the agency theory with its central problems. These problems, which are responsible for the occurrence of agency costs, will be explained in detail. Based on those findings a compensation system grounded on the two established theories and a holistic compensation approach is introduced. Finally, E-business compensation packages, which seems to be the paradigm for innovative compensation systems, are touched upon briefly. The last two sections provide ideas for future research objectives and also summarize and conclude the paper.

2 Rationale for the Shareholder Value Approach

The idea that management’s focus and responsibility is to increase value has gained widespread acceptance.4 The discussion of shareholder value and its creation first gained prominence with the publication in 1986 of Creating Shareholder Value by the U.S. academic Alfred Rappaport.5 Although shareholder value orientation is commonplace in most businesses it is still a high-decibel debate whether the manager’s sole focus should be to increase the firm’s value. A common criticism touching shareholder value is often the misunderstanding that a value-based strategy disregards the other stakeholder of the company.6 Another often articulated demur is that a strict shareholder value orientation might lead toward a short-term focus of business strategies.7 Proponents of this “balanced Stakeholders” approach point out the very high standards of living and rapid economic growth in Europe and Japan to support their view.8

However, the evidence against these arguments – and in favor of value-based shareholder wealth maximization – is mounting.9 Thus this chapter describes cornerstones of a value- based management (VBM) and will provide evidence that it will lead to greater increases in shareholder wealth. In other words, even in an increasingly competitive world, shareholder value maximization will grant benefits for all stakeholders due to the fact that there is no evidence of any conflict between shareholders and other interest groups.10 These other groups also include the management of the company, which may have in some situations different objectives than the shareholders of the company. To prevent the company from such kinds of potential interest conflicts it is essential to put performance tied compensation systems in place, which will not only lead to better performance of the employees, but also will lower the need for performance and decision control mechanism installed by the stockholders of the company.

Furthermore this chapter discusses why the classical accounting numbers must fail to measure changes in the economic value of companies because alternative accounting

measures are employed, investments (e.g. R&D) are not fully incorporated, and the time value of money and risk are ignored.11

2.1 Value-Based Management

Recent years have seen a plethora of “new” management approaches for increasing a firm’s performance: kaizen (a Japanese continuous improvement management technique), total quality management, flat organizations, business reengineering, empowerment and so on. Many of them have succeeded – but quite a few have failed.12 In most cases, the failures have been due to a lack of clear performance targets or the new management approaches were not properly aligned with the ultimate goal of creating shareholder value.13 VBM tackles this problem head on. It provides all members of the organization with a precise and unambiguous metric – value – upon which an entire strategic management can be built.14

VBM is very different from other management planning systems. It is not solely a staff- driven exercise. It focuses on better decision and strategic planning at all levels in an organization and closes the gap between strategy and its implementation.15 It recognizes that top-down command-and-control style decision-making cannot work well, particularly in large transnational operating companies.16 Accordingly, frontline managers must learn to understand value-based performance metrics for making better decisions.

Nevertheless, value-based management is not without pitfalls. It can become a staff- captured exercise which has no impact on the operating managers at the frontline or on the decisions they make.17 Thus, VBM must be an integrative process designed to improve strategic and operational decision-making throughout the entire organization by focusing on the key drivers of corporate value.18 In essence, value-based management can best be understood as a decision-guiding tool which should combine a value creation mindset with the management processes and systems that are necessary to translate that mindset into a value increasing actions.

The key is the value creation mindset, which ensures that members of the firm’s board are clear among themselves that their ultimate goal is to maximize the firm’s value. Furthermore, they have to understand which performance variables drive the shareholder value of the company.19 This understanding is essential for managers since they have to develop and implement a strategy which focuses on these key performance variables. Value-based management analytical tools, such as DCF valuation and value driver analysis, provide the managers with the needed tools to make value-increasing decisions.20 However, the understanding of this system alone is not enough to ensure that the shareholder value will increase. Moreover, it becomes crucial for the success of the value creation mindset that a management process and system is implemented likewise. This system should encourage managers and other employees to behave in a way that maximizes the value of the organization. An increasingly important factor to support the

system is to implement a performance linked compensation system, which uses appropriate measures to evaluate the performance of the company and hence the performance of the employees.21

2.1.1 Shareholder versus Management Interests

As previously mentioned, potential conflicts between shareholders and managers may arise due to different objectives of these groups. Managers, like other people, usually act in their own interest and are risk averse.22 The theory of the market economy is based on individuals promoting their self-interests reflected in market transactions to bring about an efficient allocation of resources. In a world in which principals (e.g. stockholders) have imperfect control over their agents (e.g. managers), these agents may not always engage in transactions solely in the best interests of the principals. Agents have their very own purposes and it may sometimes pay them to sacrifice the principals’ interests.23 There are, however, several factors that induce management to act more like a shareholder of the company. These factors derive from the fundamental premise that the greater the expected unfavorable consequences to the manager who destroys shareholder value, the less likely it is that the manager will act to the disadvantage of the stockholders.24

According to the above premise shareholders have to create an environment, which will induce value increasing behavior of the managers. To ensure that the management adopts a value increasing behavior a value creation mindset should be communicated to the executives. This value creation mindset consists of two key factors: compensation tied to increasing shareholder value and a relatively large ownership position for the manager.25 Along with these factors takeover threat by another organization and the fact that there is competition in the labor market should also induce corporate managers to adopt a shareholder value orientation. Further insight in these issues will be provided in section 5.

2.1.2 The Relation to other Stakeholders

A commonplace myth is that shareholder value orientation leads to conflicts with the strategic interests of other stakeholders of the company.26 Since the 1960s environmentalists, social activists, and consumer advocates argued that firms should be socially responsible, serving the public interest and not only the shareholders’ interests. In the 1990s corporate governance discussions focused more on balancing the interests of all stakeholders.27 While corporate social responsibility and stakeholder objectives may sometimes embrace different issues, each calls for the corporation to fulfill purposes beyond the shareholder wealth maximization.

However, managers certainly have to be socially responsible, which may even lead to an increase in shareholder wealth.28 This value-based approach recognizes that the requirements of the stakeholders can only be met if the company is competitive enough to survive. This view further recognizes that a firm’s long-term destiny heavily depends on a financial relationship with each stakeholder: employees seeking competitive wages, customers demanding high-quality products and competitive prices, and suppliers wanting payment of their financial claims. Management must generate enough cash flow by

operating its business efficiently to setting such claims. Analyzing these requirements show the need for generating long-term cash inflows, which is again the heart of the shareholder value approach.

Consequently, a value-creating company benefits not only its stockholders but, the value of all stakeholders: while all stakeholders are vulnerable when management fails to create

value. Juergen E. Schrempp, currently COE of Daimler Chrysler, summed this view up as: “Was den Aktionaeren nuetzt, traegt auch den Anspruechen anderer gesellschaftlicher Gruppen Rechnung.”29 Thus, self-interest dictates every stakeholder to actively engage in a partnership of value creation to serve each other’s overall goal of value maximization.

2.2 Shortcomings of Accounting Numbers

In both corporate reports and the financial press, there is an extreme focus on earnings per share (EPS) as the scorecard for corporate performance.30 The traditional accounting models of valuation are based on quarterly and annual earnings reported in leading financial publications such as “Wall Street Journal.”31 Hence, financial analyst, respectively the market, sets share prices by evaluating a firm’s growth opportunities equating its price/earnings ratio (P/E ratio) to the growth rate of earnings.32 If, for example, a company usually sells at 10 times earnings, and earnings per share (EPS) is now $1, the accounting model would predict a $10 share price. However, if earnings fall to $0.80 per share, then the company’s shares are expected to fall to $8.33 Thus, the price of the firm’s stock is influenced by the broad dissemination of accounting earnings figures and therefore strongly influenced, if not totally determined by the volatility of its earnings.34 It is frequently assumed that if a company produces “satisfactory” growth in EPS, then the market capitalization of its shares will increase.35

Although EPS is useful for some situations, its simplicity and apparent precision allows managers to ignore other important factors that affect the value of a company.36 EPS growth does not necessarily lead to an increase in the market value of the shares.37 It might be that managers’ decisions’ destroy value in the long-term, often without increasing the short-term stock price.38 This conclusion can be supported by simple economic reasoning and can be convincingly demonstrated empirically as well. This discussion of problems when using accounting numbers as performance measurement will be followed by an enumeration of the shortcomings of the return on investment (ROI) and

return on equity (ROE) known as cornerstones for measuring business performance. Finally, problems to evaluate intellectual capital with accounting numbers will be introduced.

2.2.1 Unreliable Performance Measurement – Earnings

As previously established, providing the maximum return for shareholders is the fundamental goal of any business. Shareholder return is generated by dividends and increases in share price.39 The issue is whether accounting earnings assess strategic options and measure performance consistent with the goal of the corporation. Stated more concretely, the issue is whether earnings can reliably measure the change in the present value of the company.40 In fact, there are several important reasons why earnings fail to measure changes in the market value of the firm:41

- They are heavily dependent on accounting methods.

- The amortization of goodwill.

- Time value of the money is ignored.

2.2.1.1 LIFO versus FIFO

In times of rising prices the last in, first out (LIFO) inventory method results in lower earnings than the first in, first out (FIFO) method, because the costs of goods sold is based on the more recent higher costs.42 This is followed by lower tax payments and more cash accumulation. A number of researchers have looked at how stock price is related to accounting methods. The accounting model implies that switching from FIFO to LIFO should result in a lower share price due to decreased earnings.43

Although the evidence is not entirely conclusive, Professor Shyam Sunder demonstrated that companies switching to LIFO experienced on average a 5% increase in market capitalization on the date the change was announced.44 Investors realized that LIFO would be followed by lower earnings per share, but on the other hand they also knew that

the tax savings represent a real improvement in future cash flow for stockholders, and that is what the discounted cash flow model (DCF) predicts.45 Analysis by a second group of researchers revealed that the increase in the share price mirrored a direct proportion to the present value of the taxes saved by making the switch. These studies provide strong evidence that stock prices are significantly influenced by cash generation, not book earnings.46

These findings also prove that a company adopting LIFO will sell for a higher multiple of its earnings than if it used FIFO. The increased multiple is consistent with the increased quality of LIFO earnings; inventory-holding gains are purged from income, and there are also tax savings.47

However, as this research implies, a company’s share price depends on the quality as well as the quantity of its earnings, then the accounting model of value fails. The model fails because a company’s P/E multiple is not a primary cause of its stock price: it is a result of it.48 It is therefore not possible for the accounting model to answer the question: What determines a company’s stock price?

2.2.1.2 The Amortization of Goodwill

When the purchase method is utilized to account for an acquisition, any premium paid over the “fair value” of the seller’s assets is goodwill. Hence, goodwill can be defined as the difference between the price paid for an acquired company and the “fair value” of its assets in transactions using the purchase method of accounting. Acquirers are forced to write off the goodwill, and amortized against earnings over a period not to exceed 40

years.49 Because goodwill is a non-cash, non-tax-deductible expense, the amortization per

se is of no impact in the economic model of valuation. However, in the accounting framework, amortization reduces reported earnings.50

A survey on this subject by the faculty of Lehigh University revealed that the specter of goodwill write-offs affect the behavior of some acquirers. This behavior usually reduces prices paid for businesses. Many companies apparently are willing to pay higher

acquisition premiums to treat business purchases as poolings of interests, an accounting method that does not increase the goodwill. The result of this method is that the stocks of those companies underperform the stocks of those acquirers that utilize purchase accounting.51

2.2.1.3 Time Value of Money

Another reason that leads to failures when using earnings to measure changes in economic value is that the earnings method ignores the time value of money. The economic value of an investment is the sum of anticipated future cash flows. The idea behind this financial calculation is merely that a dollar received today is worth more than a dollar received a year from now. One reason for that is potential inflation. Even more important is the fact that this dollar can be reinvested to earn money over the subsequent year.52 The discount utilized to estimate the net present value of an investment includes, therefore,

compensation for bearing risk and for expected rates of inflation. The procedure for estimating the appropriate discount rate will be explained in chapter 3.

Taking these fundamental differences between the calculation of accounting earnings and economic value into account, the accounting earnings do not necessarily lead to the creation of economic value for shareholders.53 Shareholder value will increase only if the firm earns a greater rate of return on new investments than a potential investor can expect to earn by investing in alternative, equally risky, securities.54 Earnings growth, on the other hand, can be observed in a company not only when management is investing at or above the cost of capital, but also if the company is investing below the cost of capital and thereby decreasing the value of common stock.55

In summary, an increase in earnings does not necessarily imply a rise to the corresponding shareholder value and vice versa. This is demonstrated by the fact that earnings do not reflect the firm’s level of business and financial risk, nor the change in working capital or fixed investment needed for anticipated growth. In addition, earnings are affected by a wide variety of accounting principles governing the allocation of costs to current as well

as to future time periods. However, these conventions do not ordinarily influence a firm’s cash flow and hence should not have impact on the firm’s value.56

The unreliable linkage between shareholder value and earnings is not only a theoretical argument, but can be supported by empirical research as well. Figure 1 dramatically shows the wide disparity between EPS growth and shareholder return statistics for the 1986-96 period.

illustration not visible in this excerpt

Figure 1: EPS Growth is a poor predictor for shareholder value 57

This has also been the case in prior periods; there is no apparent relationship between EPS growth and total returns for shareholders, which is again, dividend plus stock price changes.58 The diagonal line in Figure 1 above gives an idea of the preferred relationship. Ideally, a positive expected move in earnings should (all things equal) be accompanied by a positive change in stock prices along the 45-degree line.59 The coefficient of correlation of the given values in Figure 1 is only 13%, which implies that there is no significant correlation between earnings and shareholder value development. These results are confirmed by many other studies.60

2.2.2 Return on Investment (ROI) and Return on Equity (ROE)

The recognition that earnings increases are not a guarantee for an increase in shareholder wealth, especially during inflationary periods, led to the invention of popular accounting based performance measurements such as return on investment (ROI) and return on equity (ROE).

ROI is a commonplace used performance measurement of a division’s performance.61 However, taking an unreliable numerator (i.e., earnings) and relating it to an investment generated by the same accounting process does not solve the problem.62

Hurdle rates for calculating the ROI, such as internal rates of return (IRR) are often based on an estimate of the business unit’s cost of capital or the corporate cost of capital.63 In the business world the assumption is widespread that if ROI is greater than the cost of capital, shareholder value will increase. In essence, the problem with this assumption is that ROI is an accrual accounting return and is being compared with a cost of capital measure, which is an economic return demanded by the stockholders. Comparing one with the other cannot be correct and is in the end a comparison of apples with oranges.64

The ROI is computed by a wide variety of methods. Two of these methods are presented in the equation below:

illustration not visible in this excerpt

Whatever method is employed, a couple of specifications can be observed in every employed method. ROI is a single period measurement. Income is calculated for a certain year and then divided by the mean book value of assets of the same year. Thus, ROI totally ignores events beyond and previous to the current period. Taking the average ROI for several periods will certainly reduce but not eliminate this dilemma. In contrast, the DCF return for a given period explicitly considers estimates of cash flows over the entire

forecast period. Moreover, both the numerator and the denominator for the ROI-ratio are influenced by arbitrary accounting allocations, which means that they can be manipulated. For example, depreciation expense for the year is a deduction to arrive at the net income, while the additional accumulated depreciation is deducted from the firm’s assets.65

The same problem that can be observed by using ROI can also be seen by using the ROE to measure the performance of a company. Although it has been easy to calculate and is widely understood, ROE suffers distortions that influence the accuracy of the method. The ROE-ratio is usually calculated as follows:

illustration not visible in this excerpt

However, while ROI relates net income to total assets, ROE employs shareholder equity as the denominator. Whereas ROI is more commonplace for the performance evaluation for business units or on the divisional level, ROE is more popular at the corporate level. One important reason for the focus on ROI on the business unit level is the reluctance of the management to allocate debt to individual units.66 The use of ROE for the corporate level is often explained on the grounds that it is a measure of primary concern to investors.

However, ROE is based upon the same accounting earnings that were discussed in 2.2 and hence ROE shares the shortcomings of them.67 In addition, ROE is predominantly sensitive to leverage. Assuming that profits from debt financing can be reinvested at a rate of return greater than the risk free rate, ROE will increase with greater amounts of leverage. ROE will, in fact, still increase if more than optimal debt is issued and the value of the company decreases due to the increase of the financial risk. Therefore, the accounting-based performance measurements can conflict with the overall goal of

maximizing the shareholder wealth and cannot be appropriately used for a company’s strategic planning.68

2.2.3 Long-term View

A popular myth when analyzing the shareholder value is that investors are seen as too short-term oriented.69 Institutional investors, who win or lose business on the basis of their performance, are considered to be particularly greedy for quarterly earnings gains. The focus of the market, the myth is, forces corporate managers to sacrifice long-term improvements for short-term profit gains.70 To achieve this goal managers can reduce spending on research and development, focus on deal making, financial engineering and cut back the expenditures for employee training. This market myopia is especially popular among the anti-takeover group.71

A two-year study by the Council on Competitiveness and the Harvard Business School also dealt with the myopia myth. The research team, led by professor Michael Porter, concluded that an excessive focus on short-term results was cutting back the investment and undermining the U.S. competitiveness.72 That problem even worsened in the seventies and eighties, accompanied by the institutional ownership and takeover movement. However, the fact that stocks yield less in dividends than bonds pay in interest is simple proof that investors are focused on future profits. This can also be explained by the fact that investors are willing to pay higher stock prices for research-oriented companies than for other companies in low technology business. The investors are therefore paying for the prospect of higher future profits. If investors were only focusing on near-term results, all stocks would sell for the same P/E-ratio and very little emphasis would be placed on the prospect of future value creating activities.73

Shareholder Value Definition

Empirical studies support these observations. A group of Securities and Exchange economists examined the stock price reaction to announcements by 62 companies that they were planning to invest in R&D projects. The study revealed that those announcements were followed by very positive reactions of the market. That again, shows that contrary to what the accounting model would suggest, the companies with high level of spending on R&D tended to have a high P/E ratio.74 Although these results are not all

scientific, they do cast serious doubt on the myth that the market penalizes companies that invest in R&D.75

Interestingly enough, R&D expenses are usually charged off in the period they are incurred. These immediate charge-offs as operating expenses imply there is no future value to be derived from R&D.76 As a result, the company’s profits are reduced, its capital is undervalued, and hence a ROI comparison between those companies that do invest in R&D and those that are not can be seriously misleading for the investor.77

In addition to the factors mentioned above, the growth rate of new investment is a key variable affecting the magnitude of ROI. Faster-growing companies or business units will be more heavily weighted with more recent projects leading to higher book value

denominators. Hence, their ROI-ratios will be lower than those for a non-growth firm investing at an identical economic rate of return.78

Consequently, it is critical to the survival of any company to have a long-term view. However, it is also crucial to balance that with shareholder wealth creation.79

2.2.4 Intellectual Capital

One shortcoming of traditional accounting numbers as indicators of the business’s future prospects are compounded by the fact that much of what a company drives in nowadays is often based on intellectual capital which is not seen on the balance sheet.80 These developments can be especially seen by analyzing companies such as Microsoft. With only small percentages of investments capitalized for accounting purposes, ROI- and

ROE-ratios are not meaningful and cannot be compared with those companies that are principally investing in fixed assets. A good example for this is the gap between Microsoft and IBM which reflects expectations of cleverness from the folks in Redmond.

The implications of the growing importance of knowledge companies whose principal assets are intangible rather than physical can also be seen in the sky rocketing market capitalization of Internet companies.81 There is a growing interest in taking intangibles

such as research and development, customer satisfaction, and brand names into the balance sheet. Along with these points employee value should also be included, companies that create employee value (job quality, opportunity, and compensation) realize that workers are stewards of the shareholders’ investment.82

Although these suggestions might be useful, such estimates are not sufficiently reliable to warrant a place in the balance sheet. Hence, there is a strong opposition fighting against the integration of these items in the balance sheet. However, it should be kept in mind that accounting numbers and traditional financial ratios will be strongly affected by the movement from industrial companies to knowledge companies with mainly intangible assets.83

While accounting-based numbers are not reliable to assess shareholder value, this should not be seen as a failure of accounting. It should be realized that accounting relies on the quality of historical data and in the end it all comes down to the use of that data by managers and investors to forecast the companies’ future development.84

[..]

1 Copeland, T.E. (1994), p 97.

2 Wiseman, R. M./Gomez-Mejia, L. R. (1998), p. 133.

3 Rappaport, A. (1998), p. 3.

4 Rappaport, A. (1998), p. 1.

5 Black, A./Wright, P./Bachman, J. E./Davies, J. (1998), p. 22 and Kay, H. (1991), p 71.

6 Copeland, T. E./Koller, T. M./Murrin, J. (1995), p. 22.

7 Copeland, T.E. (1994), p 97.

8 Rappaport, A. (1998), p. 5. and Copeland, T.E. (1994), p 97.

9 Copeland, T.E. (1994), p 97.

10 Copeland, T. E./Koller, T. M./Murrin, J. (1995), p. 4.

11 Stewart, G. B. (1991), p 21ff and Ehrbar, A. (1998) p. 67ff.

12 Koller, T. M. (1994), p. 87.

13 Copeland, T. E./Koller, T. M./Murrin, J. (1995) , p. 96.

14 Koller, T. M. (1994), p. 87.

15 Black, A./Wright, P./Bachman, J. E./Davies, J. (1998), p. 100

16 Copeland, T. E./Koller, T. M./Murrin, J. (1995) , p. 93.

17 Koller, T. M. (1994), p. 87

18 Henry, J. (2000), p. 132.

19 Copeland, T. E./Koller, T. M./Murrin, J. (1995) , p. 98.

20 Francis, G./Minchington, C. (2000), p. 46.

21 Serven, L. (1999), p. 13.

22 Welbourne, T. M./Cyr, L. A. (1999), p. 438.

23 Wiseman, R. M./Gomez-Mejia, L. R. (1998), p. 133.

24 Barkema, H. G./Gomez-Mejia, L. R. (1998), p. 137.

25 Rappaport, A. (1998), p. 5.

26 Copeland, T. E./Koller, T. M./Murrin, J. (1995) , p. 22.

27 Mahoney, R. J. (2000), p. 1.

28 Rappaport, A. (1998), p. 7.

29 Schrempp, J. E. quoted from Bea, F. X. (1997), p. 543.

30 Black, A./Wright, P./Bachman, J. E./Davies, J. (1998), p. 12. and McClenahen, J. S. (1998), p. 63.

31 Rappaprt, A. (1998), p. 13.

32 Christofi, A. C./Christofi, P. C./Lori, M./Moliver, D. M. (1999), p. 38.

33 Stewart, G. B. (1991), p. 22

34 Rappaport, A. (1998), p. 13 and Christofi, A. C./Christofi, P. C./Lori, M./Moliver, D. M. (1999), p. 38.

35 Copeland, T. E./Koller, T. M./Murrin, J. (1995) , p. 69.

36 Stewart, G. B. (1991), p. 22

37 Kay, H. (1991), p. 71.

38 Ehrbar, A. (1998) p. Hipath opticlient attendant download free version. 41.

39 Brigham, E.E./Gapenski, L. C./Ehrhardt, M. C. (1999), p. 13.

40 Stewart, G. B. (1991), p. 24.

41 Rappaport, A. (1998), p. 14 and Attaway, M. C. (2000), p. 78.

42 Stewart, G. B. (1991), p. 24.

43 Rappaport, A. (1998), p. 14.

44 Ehrbar, A. (1998), p. 71.

45 Copeland, T. E./Koller, T. M./Murrin, J. (1995), p. 83.

46 Stewart, G. B. (1991), p. 24.

47 Ehrbar, A. (1998) p. 71.

48 Pratt, S. P. (1998), p. 182.

49 Ehrbar, A. (1998) p. 71.

50 Stewart, G. B. (1991), p. 25.

51 Ehrbar, A. (1998) p. 71.

52 Rappaport, A. (1998), p. 18.

53 Copeland, T. E./Koller, T. M./Murrin, J. (1995), p. 76.

54 Cooney, J. (1998), p. 69.

55 Bown, J. (1999), p. 44.

56 Rappaport, A. (1998), p. 20.

57 Sources: Standard & Poor’s and Stocks, Bonds, Bills, and Inflation – 1997 Yearbook in Rappaport, A. (1998), p. 21.

58 Fisher, J. (1995), p. 38.

59 Black, A./Wright, P./Bachman, J. E./Davies, J. (1998), p. 43.

60 Compare: Copeland, T. E./Koller, T. M./Murrin, J. (1995), p. 76. or Black, A./Wright, P./Bachman, J. E./Davies, J. (1998), p. 43.

61 Madden, B. J. (1998), p. 34.

Alfred Rappaport Shareholder Value Pdf Reader Online

62 Rajan, S. R. (1999), p. 41.

63 Shinder, M./McDowell D. (1999), p. 4.

Alfred Rappaport Shareholder Value Pdf Readers

64 Rappaport, A. (1998), p. 21.

65 Rappaport, A. (1998), p. 23.

66 Chen, S./Dodd, J. L. (1997), p. 320.

67 Stewart, G. B. (1991), p. 84.

68 Borchers, S. (1997), S. 125.

69 Ehrbar, A. (1998) p. 72.

70 Donlon, J. P. (1998), p. 52.

71 Blinder, A. S. (2000), p. 19.

72 Ehrbar, A. (1998) p. 72.

73 Ehrbar, A. (1998) p. 73.

74 Evans, F. C. (2000), p. 40.

75 Copeland, T. E./Koller, T. M./Murrin, J. (1995), p. 87.

76 Stewart, G. B. (1995), p. 118.

77 Dierks, P. A./Patel, A. (1997), p. 54.

78 Siegert, T. (1995), S. 587.

79 Donlon, J. P. (1998), p. 52.

80 Rappaport, A. (1998), p. 31.

Alfred Rappaport Shareholder Value Pdf Reader Pdf

81 De Heer, M./Koller, T. M. (2000), p. 62.